by Sota Homes | Jan 7, 2022 | Home Buying Tips, Home Selling Tips, Homeowner Tips, Real Estate

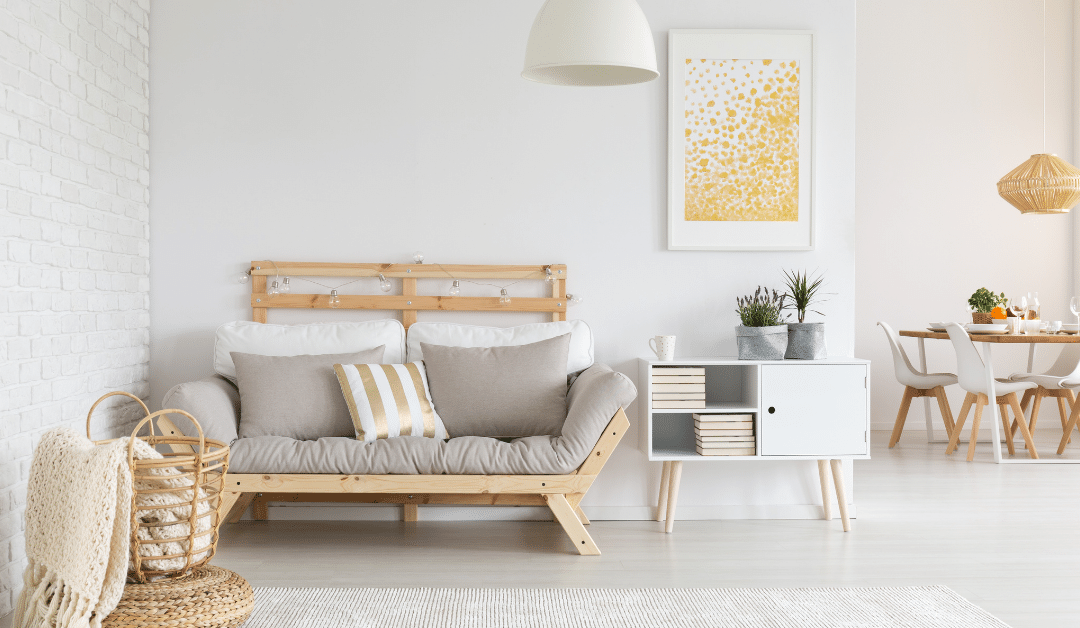

In today’s real estate market – selling or buying a home can be a stressful and sometimes nerve-wracking experience, but it doesn’t have to be. When you work with a professional real estate agent, it ensures you aren’t burdened by the stress of finding the perfect home or selling at market value by yourself. An agent handles the tough and stressful parts of a home sale while you relax from the comfort of your home.

Working with a real estate agent makes the experience much less stressful, but there are plenty of other benefits to working with an agent as well. Here are just five of them.

Selling or buying a home requires you to prepare tons of paperwork such as government and mandated legal documents. For some, this can be confusing and frightening as one mistake could lead to legal implications or a failed transaction. This is where your agent comes in handy. They are well-verseed with all the documents needed for the sale and its legal procedures.

Agents look out for their client’s best interest. They want to ensure the transaction will be successful which is why you can count on them to advocate for your needs during the transaction process.

Buyers and sellers want one thing: to get the best deal. Negotiating directly with the buyer or seller is difficult, thus hiring a real estate agent increases your chance to get the best deal. Real estate agents have mastered the art of negotiation and they always strive to get you the best deal possible.

Real estate agents and brokers have their own networks and access to a Multiple Listing Service (MLS). They also have multiple connections to other agents, lenders, title companies, home inspectors, staging professionals, and many more. Your agent will ensure you are taken care of by the best!

Nobody (other than you) cares more about the sale of a home than your agent, and they are experts at knowing when the market is at its most competitive. So trust your agent to close the deal exactly as you expected.

There are numerous benefits to hiring a real estate agent. They have the proper connections, will advocate on your behalf, and are well-versed in all things real estate. So, whether you are buying or selling a home, hiring an agent is the best choice you can make.

by Sota Homes | Jan 3, 2022 | Housing Development, New Construction, Oak Grove

Welcome to River Bluffs!

Xenia Street NW, Oak Grove, MN 55070

Welcome to River Bluffs! This quiet development in Oak Grove, MN is the perfect place for someone looking for an acreage lot in the country. This beautiful neighborhood features views of the Rum River and is just a short distance from Oak Grove and St. Francis amenities.

The available lots range in size from 2 acres to 4.95 acres and allow for various home styles. Enquire about available lots, prices, and styles today.

“The city of Oak Grove is home to a growing community of nearly 9,000 people. Located just over 40 miles north of Minneapolis, Oak Grove offers a good balance of recreation and business.

Oak Grove is a part of Independent School District 15, otherwise known as St. Francis Area Schools. There are three elementary schools, one…”

8th Street N, Zimmerman, MN 55398

86th Street NE, Monticello, MN 55362

View our other developments HERE.

Price Custom Homes is setting a standard in building quality and efficiency, delivering unparalleled client satisfaction with quality products, services, and modern custom-built homes.

Price Custom Homes has been designated a Reggie Award Winner five years in a row and a Top 25 Builder in 2018 and 2019.

Want to live in River Bluffs? Contact us today!

by Sota Homes | Jan 3, 2022 | Home Buying Tips, Homeowner Tips

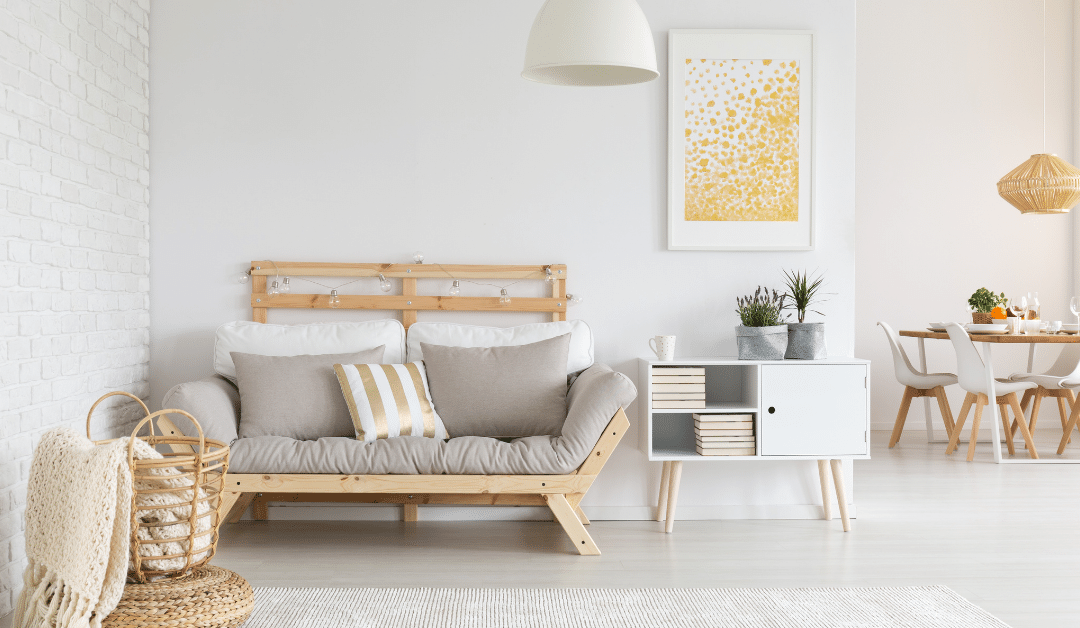

After finding your dream home and applying for a mortgage, you may be tempted to go shopping for your new home or reward yourself with a new credit card, but be wary of making any large financial changes until after your mortgage is approved. Sometimes even something as small as depositing cash into your bank account can affect your mortgage.

So, always consult your lender about any financial decisions prior to closing on a home, and in the meantime, read up on six things to avoid when applying for a mortgage.

Large purchases tend to come with new monthly payments which in turn create new qualifications for a mortgage. By purchasing large items, your debt-to-income ratio rises and you may end up no longer qualifying for your mortgage.

Lenders need to track where your money is coming from and cash is not easily traced. If you need to deposit cash into your account, consult with your lender about the proper way to record the transaction.

Lenders need to check your credit score in order to determine your interest rate on the home loan. If you apply for new credit, an organization has to run a credit report and will more than likely lower your score. On the other hand, if you close an account, the lender cannot evaluate how long you’ve had the account or the percentage of credit you use. Both situations can impact your eligibility to qualify for a mortgage.

It is harder for lenders to track your money if you transfer it to another account. Similar to avoiding cash deposits, speak with your lender before transferring any money into a new bank account.

When you co-sign a loan, your debt-to-income ratio rises. Even if you never make a single payment on the loan, your lender will still count the payments against you which could result in you no longer qualifying for your mortgage.

Your debt-to-income ratio is a large factor in determining your mortgage. If your income changes or you lose your job, it can significantly impact your ability to acquire a home loan.

If you’re unsure about a financial decision prior to closing on your home, always consult your lender. They are qualified to explain how certain financial moves may impact your home loan.

More questions or looking to get pre-approved for a home loan? Click here.